Private limited company registration in Chennai

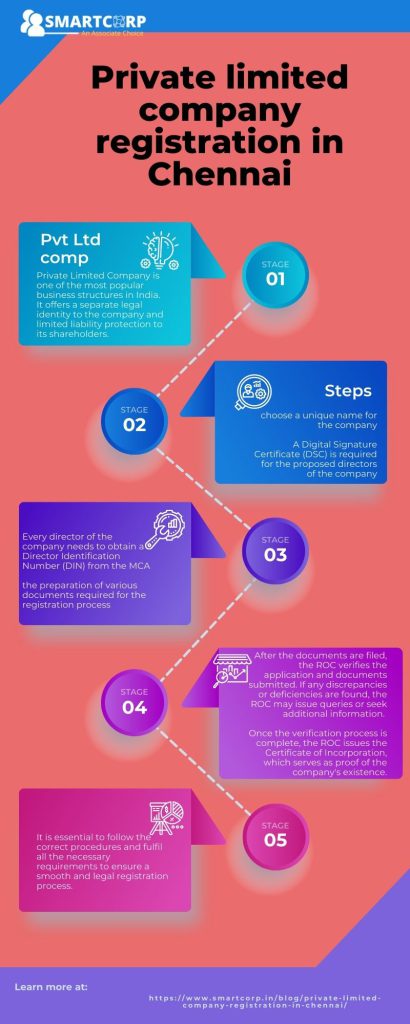

Private Limited Company is one of the most popular business structures in India. It offers a separate legal identity to the company and limited liability protection to its shareholders.

The process of registering a private limited company involves several steps and compliances that need to be followed as per the regulations laid down by the Companies Act, 2013. In this blog, we will discuss the private limited company registration process in India.

Name Reservation:

The first step in doing a private limited company registration in Chennai is to choose a unique name for the company. The proposed name should not be identical or similar to an existing company or trademark.

The name should also comply with the naming guidelines provided by the Ministry of Corporate Affairs (MCA). Once the name is finalized, an application for name reservation needs to be filed with the Registrar of Companies (ROC) along with the required fees.

Obtaining Digital Signature Certificate (DSC):

A Digital Signature Certificate (DSC) is required for the proposed directors of the company.

It is a secure digital key that authenticates the identity of the individual signing the electronic documents. DSC can be obtained from certifying authorities recognized by the MCA.

Obtaining Director Identification Number (DIN):

Every director of the company needs to obtain a Director Identification Number (DIN) from the MCA. DIN can be obtained by filing an online application for private limited company registration in Chennai along with the required identity and address proof documents.

Preparation of Documents:

The next step involves the preparation of various documents required for the registration process.

These documents include the Memorandum of Association (MOA) and Articles of Association (AOA), which define the company’s objectives, rules, and regulations.

Other documents such as the consent of directors, declaration by subscribers, and address proof of the registered office also need to be prepared.

Filing of Incorporation Documents:

Once the documents are prepared, they need to be filed with the ROC. The incorporation documents include the MOA, AOA, Form INC-32 (SPICe – Simplified Proforma for Incorporating Company Electronically), and other necessary forms.

These forms contain details about the company, its directors, shareholders, registered office, and share capital. Along with the forms, the prescribed fees for private limited company registration in Chennai also need to be paid.

Verification and Approval:

After the documents are filed, the ROC verifies the application and documents submitted. If any discrepancies or deficiencies are found, the ROC may issue queries or seek additional information.

Once the verification process is complete, the ROC issues the Certificate of Incorporation, which serves as proof of the company’s existence.

Post-Incorporation Compliance:

After the company has private limited company registration in Chennai, certain post-incorporation compliances need to be followed. These include obtaining the Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department, opening a bank account in the company’s name, and obtaining any necessary licenses or permits specific to the nature of the business.

Statutory Compliances:

A private limited company is required to comply with various statutory requirements on an ongoing basis.

These include maintaining books of accounts, conducting annual general meetings, filing annual financial statements and annual returns with the ROC, and complying with applicable tax laws, such as Goods and Services Tax (GST), if applicable.

What happens if company is struck off?

In India, companies that fail to comply with the legal and regulatory requirements may face the consequence of being struck off the register of companies.

Striking off means the removal of the company’s name from the records of the Registrar of Companies (ROC).

This action is taken when the company is deemed non-operational, dormant, or involved in fraudulent activities.

Legal Status:

When a company with private limited company registration in Chennai is struck off, it loses its legal existence as a separate entity. It is no longer recognized as a registered company by the government authorities. The company’s name is removed from the register maintained by the ROC, and it is considered as if it never existed.

Inability to Conduct Business:

Once a company is struck off, it cannot carry out any business activities or transactions in its name. The company loses its capacity to enter into contracts, undertake financial transactions, or engage in any business operations. It becomes illegal for the struck-off company to continue its business activities.

Liability of Directors and Shareholders:

Even after a company with private limited company registration in Chennai is struck off, the liability of the directors and shareholders does not cease. They remain personally liable for any debts, obligations, or legal proceedings related to the company.

The liability extends to the period during which the company was in operation, including the time after it has been struck off.

Recovery of Assets:

When a company is struck off, its assets, properties, and bank accounts are considered to be ownerless. These assets are transferred to the government’s custody, specifically to the Public Fund of India.

The government takes over the responsibility of safeguarding these assets and may initiate the process of liquidation or distribution as per the applicable laws.

Restrictions on Directors:

The directors of a struck-off company face certain restrictions and consequences. They are disqualified from being appointed as directors or holding office in any other company for a specific period, as per the provisions of the Companies Act, 2013.

The disqualification may vary depending on the nature of non-compliance or fraudulent activities that led to the striking off of the company.

Consequences for Shareholders:

Shareholders of a struck-off company lose their ownership rights and entitlements. The shares held by them become null and void. They cannot transfer or sell their shares or claim any dividends or profits from the company that can get private limited company registration in Chennai. The shareholders are left with no legal recourse for their investment in the struck-off company.

Revival or Restoration:

In certain cases, it is possible to revive or restore a struck-off company. The process of revival involves making an application to the National Company Law Tribunal (NCLT) for the restoration of the company’s name.

The NCLT considers various factors, such as the reasons for striking off, the intention to carry on business, and the payment of pending statutory dues, before deciding on the revival of the company.

Winding-up and Liquidation:

If a struck-off company is not revived or restored within a specified period, the NCLT may order the company to be wound up and liquidated.

The liquidation process involves the sale of the company’s assets and distribution of the proceeds to repay the creditors and shareholders, as per the established priority of payments.

Conclusion

Doing private limited company registration in Chennai involves a systematic process that requires adherence to the provisions of the Companies Act, 2013. It is essential to follow the correct procedures and fulfil all the necessary requirements to ensure a smooth and legal registration process.

Seeking professional guidance from company registration experts or chartered accountants can help navigate through the complexities and ensure compliance with all the legal formalities.