Reason for Limited Liability Partnership (LLP) registration

Here in this blog, we have discussed about the reason for Limited Liability Partnership and the steps involved in LLP registration.

By the way, LLP stands for Limited Liability Partnership. An LLP is described as a hybrid form of business because it offers more flexibility that is normally there in case of a partnership, as well as the benefits of limited liability associated with the limited liability firm. An LLP is basically an independent legal entity.

A LLP combines the advantages of both the Company and Partnership in a single form of organization. The major difference between for that of other traditional partners is that a partner in LLP is not responsible for misconduct of another partner. All partners will enjoy the limited liability for the protection of each individual, which is similar to that of the shareholders of a corporation. Reason for LLP Registration is discussed below:

Reason for LLP Registration:

In India, LLP was governed under the Limited Liability Partnership Act, 2008. In LLP the partners have the right to manage the business directly or indirectly, unlike corporate shareholders.

Moreover, an LLP can continue doing business in spite of changes of partners. It can hold property and also enter contracts on its own. As such it is held liable to the fullest extent of its assets. However, the liability of the partners is restricted to the contribution that they have made in the same.

LLP Agreement:

Since, an LLP is bestowed with the status of a body corporate as well as a separate legal entity it has perpetual succession. All the individual partners happen to be safeguarded from any joint liability that may be created by the wrong business decisions taken by the other partner. The same reason can also be applied to any misconduct on part of partners. It is the main partnership agreement that governs the mutual duties and rights of the partners .

At times, such agreements may also be reached between an LLP and the partners. In that case that particular agreement would be accorded the status of main governing entity. However, since it is an independent legal entity, an LLP cannot be considered to have been absolved of the liability towards its various obligations

Requirement for LLP incorporation:

In a limited liability partnership, there is no share capital like corporate but there has to be some contribution from each partner which is known as partner’s capital for the LLP formation. However there is no minimum requirement of capital for LLP registration.

In essence, a person can start a limited liability partnership with any amount of capital. There is no reason to show the proof of capital investment during the incorporation process. Partner’s contribution can be tangible, movable or immovable or intangible property and any other LLP benefits. The reason behind LLP formation is limited liability.

Nature of Limited Liability Partnership:

- LLP is generally formed to carry on a lawful business, which includes any trade, business or profession.

- Moreover, LLP is a body corporate having a legal separate entity from its partners, also having a perpetual succession. Changes in the partners shall not affect the rights, liabilities, and existence of the LLP.

- LLP can acquire, hold, develop or dispose of a property.

- LLP can sue, can be sued and can possess a common seal and do such acts as body corporate are lawfully allowed to do.

- Any liabilities associated to LLP is met out of the property of the LLP.

Advantages of a Limited Liability Partnership:

- The cost of LLP formation is low

- Easy management

- There is no need for the capital contribution

- No restrictions for the number of partners

- Less agreement requirement

- Less Government intervention

- In LLP, auditory requirement will be there in the case of contributions exceeding Rs. 25 lakh or turnover exceeding Rs. 40 lakh

- Easy to dissolve or wind-up the firm.

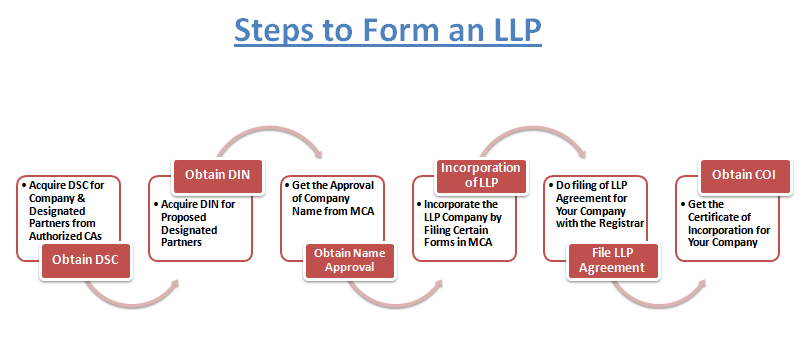

Steps involved in LLP Application process:

Step 1: Obtain Digital Signature Certificate (DSC) for Proposed Designated Partner

The first step is to acquire the DSC (Digital Signature Certificate) for Designated Partner of LLP or the proposed LLP, their signature and photo is to be affixed on the e-form along with attested Identity and address proof documents to obtain Class 2 or Class 3 DSC from any authorised certifying authority.

Step 2: Obtain Designated Partners Identification Number (DPIN)

In second step, you have to apply for DPIN/ DIN (Designated Partner Identification Number/ Director Identification Number) for all designated partners. And for this, you have to apply for DIN through e-Form DIR-3 in MCA portal.

Step 3: Obtain Name Approval from MCA

In third step, before incorporation or registration of a limited liability partnership (LLP) company, the applicant/ entrepreneur has to reserve the proposed name of LLP in MCA database and he needs to file the E-Form 1 for ascertaining the availability and reservation of unique name of the LLP business.

Step 4: Incorporate the LLP Company by Filing Certain Form

In fourth step, once the name is reserved by the ROC, then you can incorporate the LLP Company by filing E-Form 2 along with necessary documents, which is typically used for incorporating a new limited liability partnership.

E-Form 2 contains all details of LLP proposed to be incorporated, partners or designated partners details and also the consent of the partners or designated partners to act as partner or designated partner.

After submission of complete documents at ROC; then the registrar will inspect and verify it, if they satisfied with your relevant compliance provisions of LLP Act, then will register the LLP. And you will be issue an incorporation certificate in Form 16 within 14 days of filing e-Form 2.

Step 5: Filing of LLP Agreement and Partners Details

In fifth step, the applicant has to file LLP Agreement with the Registrar in E-form 3 within 30 days of incorporation of LLP. And the execution of LLP Agreement is mandatory as per Section 23 of LLP Act, 2008.

There are certain documents that have to be provided by both the LLP as well as the partners in order for the company to be registered. An LLP needs to furnish proof of its registered office address and its DSC. The partners have to provide their PAN cards or any other reason for ID proof, their address proof, their residence proof, and photographs.

In case the partners are foreign nationals or non-resident Indians they have to provide their passports. It is very important that these passports are either apostilled or notarized by relevant authorities in the relevant home country of that partner.

Conversion of Existing Firms into LLP:

Consequently, a firm can apply to the Registrar of Companies in the form prescribed along with the prescribed documents for converting itself into an LLP. It is important to note that all the partners of the firm become partners of the LLP.

Assets and liabilities of the firm can be transferred on LLP registration, to and vest in the LLP and the firm will stand dissolved.

However, it is important to note that every official correspondence of the LLP should bear a statement ,not later than fourteen days after the registration that it was converted from a firm into an LLP, along with the date of registration. This activity shall be carried on for a period of twelve months commencing not later than fourteen days after the date of LLP registration.

Conclusion:

LLP Registration can be done easily with Smartcorp, Tirupur. We have experts team for providing you great support, Free consultation, ISO Certified services, Affordable pricing, No More Delay, Hurry up!!!