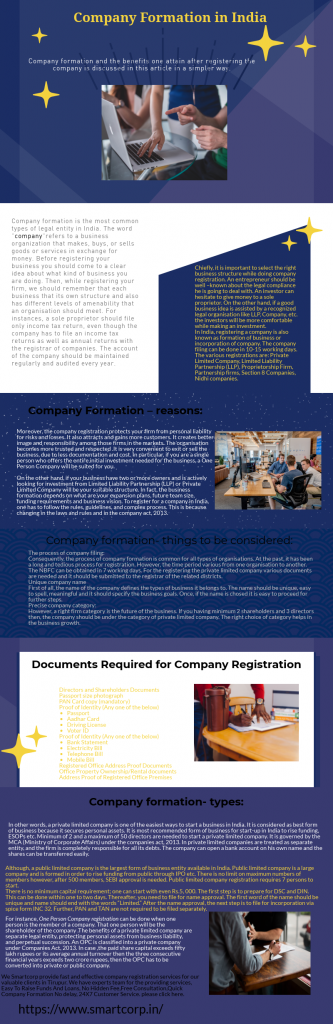

Company Formation in India

Company formation, the benefits one attain after registering the company is discussed in this article in a simpler way.

Company formation is the most common types of legal entity in India. The word “company“refers to a business organization that makes, buys, or sells goods or services in exchange for money. Before registering your business you should come to a clear idea about what kind of business you are doing. Then, while registering your firm, we should remember that each business that its own structure and also has different levels of amenability that an organisation should meet. For instances, a sole proprietor should file only income tax return, even though the company has to file an income tax returns as well as annual returns with the registrar of companies. The account of the company should be maintained regularly and audited every year.

Chiefly, it is important to select the right business structure while doing company registration. An entrepreneur should be well –known about the legal compliance he is going to deal with. An investor can hesitate to give money to a sole proprietor. On the other hand, if a good business idea is assisted by a recognized legal organisation like LLP, Company, etc. the investors will be more comfortable while making an investment.

In India, registering a company is also known as formation of business or incorporation of company. The company filing can be done in 10-15 working days. The various registrations are: Private Limited Company, Limited Liability Partnership (LLP), Proprietorship Firm, Partnership firms, Section 8 Companies, Nidhi companies.

Company Formation -short review

Company Formation – reasons:

Moreover, the company registration protects your firm from personal liability for risks and losses. It also attracts and gains more customers. It creates better image and responsibility among those firms in the markets. The organisation becomes more trusted and respected .It is very convenient to exit or sell the business, due to less documentation and cost. In particular, if you are a single person who offers the entire initial investment needed for the business, a One Person Company will be suited for you.

On the other hand, if your business have two or more owners and is actively looking for investment from Limited Liability Partnership (LLP) or Private Limited Company will be your suitable structure. In fact, the business formation depends on what are your expansion plans, future team size, funding requirements and business vision. To register for a company in India, one has to follow the rules, guidelines, and complex process. This is because changing in the laws and rules and in the company act, 2013.

Company formation- things to be considered:

The process of company filing:

Consequently, the process of company formation is common for all types of organisations. At the past, it has been a long and tedious process for registration. However, the time period various from one organisation to another. The NBFC can be obtained in 7 working days. For the registering the private limited company various documents are needed and it should be submitted to the registrar of the related districts.

Unique company name

First of all, the name of the company defines the types of business it belongs to. The name should be unique, easy to spell, meaningful and it should specify the business goals. Once, if the name is chosed it is easy to proceed for further steps.

Precise company category:

However, a right firm category is the future of the business. If you having minimum 2 shareholders and 3 directors then, the company should be under the category of private limited company. The right choice of category helps in the business growth.

Documents Required for Company Registration

Directors and Shareholders Documents

Passport size photograph

PAN Card copy (mandatory)

Proof of Identity (Any one of the below)

- Passport

- Aadhar Card

- Driving License

- Voter ID

Proof of Identity (Any one of the below)

- Bank Statement

- Electricity Bill

- Telephone Bill

- Mobile Bill

Registered Office Address Proof Documents

Office Property Ownership/Rental documents

Address Proof of Registered Office Premises

Company formation- types:

Private limited company:

In other words, a private limited company is one of the easiest ways to start a business in India. It is considered as best form of business because it secures personal assets. It is most recommended form of business for start-up in India to rise funding, ESOPs etc. Minimum of 2 and a maximum of 50 directors are needed to start a private limited company. It is governed by the MCA (Ministry of Corporate Affairs) under the companies act, 2013. In private limited companies are treated as separate entity, and the firm is completely responsible for all its debts. The company can open a bank account on his own name and the shares can be transferred easily.

Requirements for Private Company Registration

For instances, Minimum two people are required to start a private limited company in India. The investment of capital amount should within 2 months of the company incorporation. Students over 18 years of age can form any type of company in India. Employees are not allowed by their employers to form a company and be a director. They can hold shares but cannot take position as director.

If you have an idea of opening a company in India, then check your employment agreement and seek permission from the respective employer. The private limited company can be started with even Rs.5, 000. Once if the incorporation process is over, proceed with the necessary registrations like GST. This is due to the fact that without tax license the business is considered as an illegal one.

Public limited company

Although, a public limited company is the largest form of business entity available in India. Public limited company is a large company and is formed in order to rise funding from public through IPO etc. There is no limit on maximum numbers of members however, after 500 members, SEBI approval is needed. Public limited company registration requires 7 persons to start.

There is no minimum capital requirement; one can start with even Rs.5, 000. The first step is to prepare for DSC and DIN. This can be done within one to two days. Thereafter, you need to file for name approval. The first word of the name should be unique and name should end with the words “Limited.” After the name approval, the next step is to file for incorporation via spice form INC 32. Further, PAN and TAN are not required to be filed separately.

One Person Company

For instance, One Person Company registration can be done when one person is the member of a company. That one person will be the shareholder of the company .The benefits of a private limited company are separate legal entity, protecting personal assets from business liability, and perpetual succession. An OPC is classified into a private company under Companies Act, 2013. In case ,the paid share capital exceeds fifty lakh rupees or its average annual turnover then the three consecutive financial years exceeds two crore rupees, then the OPC has to be converted into private or public company.

Key Features of One Person Company (OPC)

In other words, only one person can be a member or shareholder. The minimum paid share capital can be Rs. 1 lakh. In case of death of the shareholder, then the nominee or the other person becomes the member of the company. There will be no need to have any Annual general meeting each year. It is easy to get loans from the banks. In an OPC, there are chances for a company to make contract with the shareholder or directors. Directors rent and can earn interest are deductible expenses.

We Smartcorp provide fast and effective company registration services for our valuable clients in Tirupur. We have experts team for the providing services, Easy To Raise Funds And Loans, No Hidden Fee,Free Consultation,Quick Company Formation No delay, 24X7 Customer Service. please click here.