Supply under GST: A Detailed Breakdown of Key Components

GST is levied on the “supply” of goods and services, making it crucial for businesses and taxpayers to fully understand its meaning, types, and implications. The broad definition of supply ensures comprehensive tax coverage and helps determine tax liability for various transactions.

Definition of Supply

Under GST, “supply” is defined as the sale, transfer, barter, exchange, license, rental, lease, or disposal of goods or services made or agreed to be made for consideration by a person in the course or furtherance of business. Essentially, any form of transaction involving goods or services can qualify as a supply, provided that it occurs within the scope of a business activity.

The definition goes beyond monetary transactions, covering situations like barters and exchanges where goods or services are traded without direct payment. This comprehensive definition ensures that most business activities fall within the taxable ambit of GST.

Key Elements of Supply

Several key elements are necessary for a transaction to qualify as “supply” under GST:

- Consideration: In most cases, supply must involve consideration, either in money or kind, for it to be taxable under GST. However, the GST law specifies certain instances where supply is taxable even without consideration. For example, transactions involving business assets or the provision of self-supplied services between related parties (such as between branches of the same business) may still be subject to GST, even if no payment is made.

- Business Purpose: The supply must be made in the course of or in furtherance of business. This means that the transaction must be part of regular or ongoing business activities intended for economic gain. Personal or non-business-related transactions generally fall outside the scope of GST.

- Taxable Event: In GST, the taxable event is the “supply” of goods or services, replacing the previous taxable events like manufacturing, selling, or providing a service. GST is levied at the point of supply, ensuring a single, comprehensive tax system.

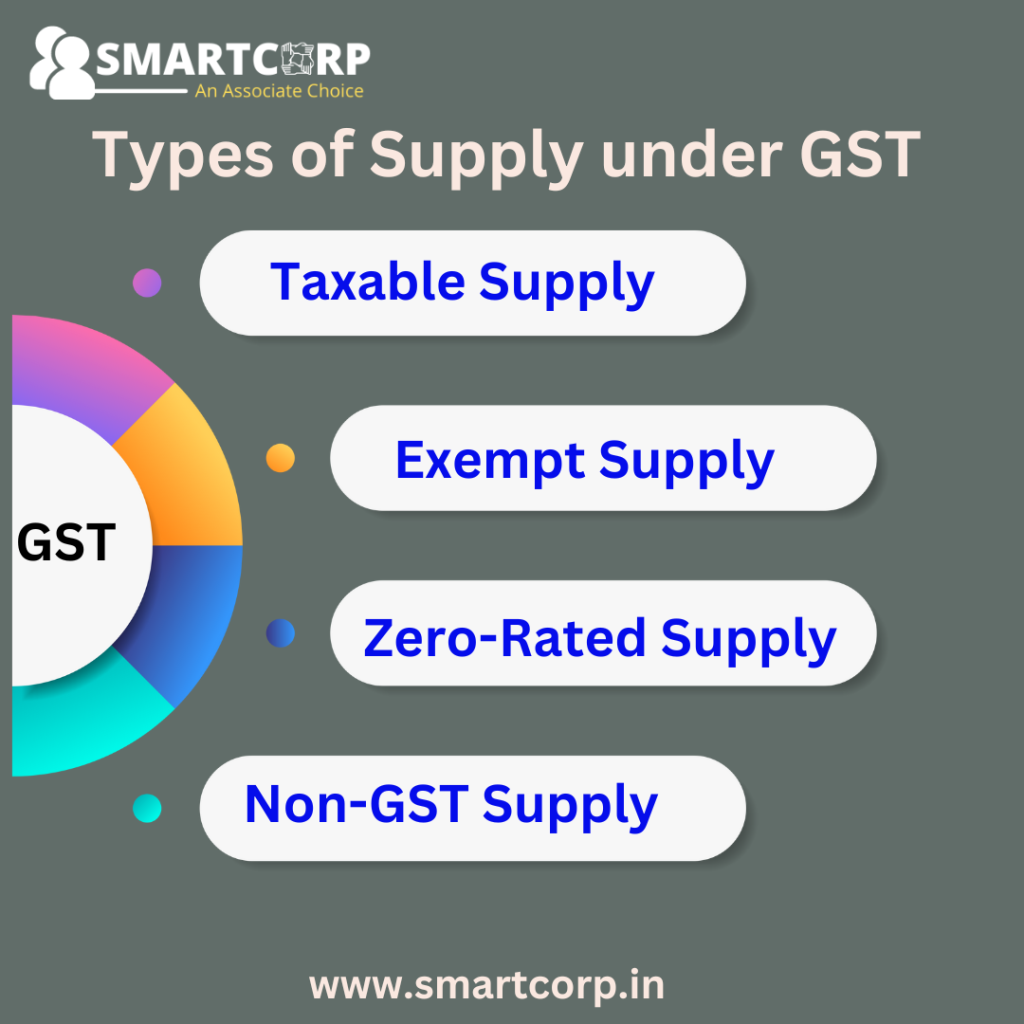

Types of Supply

The GST regime defines different types of supply, each with distinct tax implications. These types of supply include:

- Taxable Supply: A taxable supply refers to the supply of goods or services that attract GST at the prescribed rates. This is the most common form of supply, covering most business transactions. The applicable GST rate depends on the nature of the goods or services supplied.

- Exempt Supply: Exempt supply refers to goods or services that are not subject to GST. While exempt supplies attract no GST, businesses involved in such supplies are also unable to claim input tax credit (ITC) on related purchases. Common examples of exempt supplies include certain essential goods like food products, health services, and educational services.

- Zero-Rated Supply: Zero-rated supplies include exports and supplies made to Special Economic Zones (SEZs). These supplies are subject to a 0% GST rate, but businesses can still claim input tax credit on the goods and services used to make these supplies. This makes zero-rated supplies beneficial for exporters, helping them remain competitive in the global market.

- Non-GST Supply: Some goods and services fall outside the purview of GST altogether. These include items like alcoholic liquor for human consumption and petroleum products (currently). These supplies remain subject to taxation under other existing laws and fall outside the scope of GST.

Place of Supply

The concept of “place of supply” is crucial in determining whether a supply is inter-state or intra-state, which affects how GST is levied. Inter-state supplies are subject to Integrated GST (IGST), while intra-state supplies are subject to both Central GST registration in Coimbatore(CGST) and State GST (SGST). The rules for determining the place of supply vary depending on whether the supply involves goods or services and whether the transaction is domestic or international. For example, you typically determine the place of supply for goods by where you deliver them, while for services, it depends on where you perform or receive the service

Time of Supply

The “time of supply” indicates when businesses consider goods or services as supplied. It plays a crucial role in determining the applicable tax rate, the value of the supply, and the due dates for tax payments. Various events, such as issuing an invoice, receiving payment, or completing the service, can trigger the time of supply.Understanding the time of supply enables businesses to manage their tax obligations more effectively, ensuring they make timely tax payments and apply the correct tax rates

Reverse Charge Mechanism

Under the regular GST framework, the supplier is responsible for paying GST on goods or services. However, the Reverse Charge Mechanism (RCM) shifts this responsibility to the recipient in certain cases. The government commonly applies this mechanism to imports and specific services, assigning the recipient the responsibility to manage the tax payment.

For example, in import transactions or in the case of services like legal consultancy, the recipient of the service is responsible for paying GST under the reverse charge mechanism.

Importance of Supply in the GST Regime

The concept of supply is central to the GST framework. Understanding its definition, key elements, and types is essential for businesses to remain compliant with the law.

Correctly identifying whether a transaction qualifies as a taxable supply is crucial for determining tax liability and claiming input tax credit.

In summary, the broad definition of supply covers most business activities under GST. The rules around place and time of supply, as well as the reverse charge mechanism, add further layers to the concept. By fully grasping the concept of supply, businesses can optimize their tax planning, avoid penalties, and ensure seamless compliance with GST requirements.